Open 6:30am to 6:30pm

Monday to Friday

Guardian Childcare & Education Fig Tree Pocket

- Leading programs where children aged six-weeks to six years learn and discover through play.

- Highly experienced Educators and degree-qualified Teachers support children to grow and thrive.

- Safe, secure environments that support children’s social and emotional development.

- High quality two-year kindergarten program that prepares children for school, with the benefits of long day care. Plus 4yr old children get 15hrs of free Kindergarten a week from 1st Jan 2024.

Come and see the Centre for yourself, meet the team and have all your questions answered. Book a tour today.

Hours

Mon to Fri 6:30am to 6:30pm

Address

233 Fig Tree Pocket Road

Fig Tree Pocket,

QLD,

4069

Welcome to our Centre

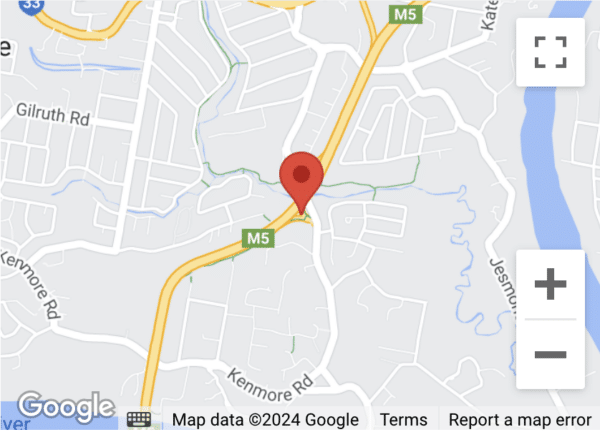

Welcome to Guardian Childcare & Education Fig Tree Pocket! Our childcare centre is strategically positioned to serve families residing in neighbouring suburbs such as Graceville, Corinda, Kenmore, Jindalee, and Fig Tree Pocket itself.

- Build on their existing knowledge and explore new ideas,

- Develop the necessary numeracy and literacy skills for life and;

- Become more independent and confident in their abilities

Meet our Centre Manager

Rhythm of The Day

With endless possibilities, there’s never a dull moment at Guardian and no two days are the same. Here’s what a day at Guardian might look like. Please note, this will vary depending on centre opening hours.

-

Morning

Handover time with children, families and our friendly Educators. There's a chance for conversation to share what's important for the day/what's happened the night before at home.

-

Morning

Breakfast time where families are welcome to stay and enjoy breakfast with the children.

-

Morning

As children are arriving and families are coming and going, there's an opportunity for play as well as family grouping, open-plan play and multi-age grouping.

-

Morning

As the children come together, planned experiences begin. This is where the Guardian programs and practices come to life. Examples of learning include numeracy, literacy, language, critical thinking, problem solving, leadership, social skills, technology, science, creative arts, curiosity and more.

-

Morning

There's an opportunity for children to come together and enjoy morning tea.

-

Mid-morning

Following morning tea, the planned experiences continue. This includes both indoor and outdoor programs.

-

Afternoon

There's an opportunity for children to come together for lunch. With an open-door policy, families are able to join the centre for meals and excursion if they wish.

-

Afternoon

For children who want to, or need to, there's an opportunity to sleep, rest or relax. For children who don't need to rest, there are planned experiences, which are more likely to be outdoors.

-

Afternoon

Children come together for afternoon tea in small groups or with siblings (they can also rest and play together, too). This time also presents an opportunity to reflect on the day.

-

End of the day

As families arrive to pick up children, there's an opportunity to speak to Educators and share information about the day.

-

End of the day

Some centres offer early tea or light snack at the end of the day, which they can grab as they leave the centre. We’re mindful of how routines vary at home, so if throughout the day, we notice children look tired, food will be provided.

Helpful Information

Opening Hoursexpand_more

Good to Know - What to Bring expand_more

What we Provide

- Nappies and wipes

- Bed linen

- Guardian hat

- SPF 50+ sunscreen

- High quality baby formula

- All nutritious meals and snacks

What to Bring

- Water bottle

- Spare change of clothing, labelled

- Soft toy or comfort blanket for nap time

- Baby's bottles for formula or breastmilk

Our Educators expand_more

Our team of Educators are committed and passionate about ensuring your child will be safe, nurtured and cared for every day. At Guardian, children are encouraged to engage in interest-led play that creates learning and meaningful experiences.

Our Educators seek to optimise diverse learning opportunities and implement the Curriculum as framed by the Early Years Learning Framework.

You and Your Child expand_more

All Guardian Centres provide a Centre-to-Family communication platform so families can maintain contact with their children’s experiences through photos, stories and learning outcomes.

Our Centres use Storypark and each family is provided with a secure login to access on their computers, mobiles or apps.

Learn More About Our Centre expand_more

Guardian Childcare & Education Fig Tree Pocket is a warm and inviting early learning centre west of Brisbane. Our Centre gets its name from Fig Tree Pocket Rd, which is where we’re located. We have a team of experienced Educators and degree-qualified Teachers who get to know each and every child on an individual level to provide the highest standard of care in those critical first few years.

Our Centre, located in the heart of Fig Tree Pocket, provides convenient accessibility for families residing in nearby suburbs as well. Specifically, residents of Indooroopilly, Kenmore, Chapel Hill, Corinda, and Sherwood would find our location particularly beneficial due to the short travel distances. Additionally, the easy access from the Western Freeway makes our centre a practical choice for those commuting from further suburbs of Brisbane.

Our childcare philosophy is that no two days should be the same, and that’s reflected in the fun and excitement we see lighting up our children’s faces every single day. Each morning brings new and engaging learning opportunities, whether it be through a structured activity or some new play-based resources for children to let their imaginations run wild.

We have a large natural playground that lets children develop their independence and confidence in a safe and secure setting. The outdoor area as a whole is spacious, nestled on three-quarters of an acre, allowing children to roam freely and providing plenty of space for exploration and running around.

The modern fort is a popular attraction, with the children coming up with all sorts of imaginative games and ideas for how it can be used for learning. We also have two large sandpits, which provide motor skill development opportunities for younger children and introduce an understanding of shapes and building for the older ones.

In addition to our various play structures, we also have plenty of natural space for children to keep their imaginations engaged. We have large open grass areas with beautiful big shady trees for cooling down under in summer. There are also some gorgeous garden areas and a digging patch for when children feel like getting their hands dirty in nature.

We have a veggie garden and chicken coop, where children can collect fresh fruits and vegetables, as well as eggs, throughout the day. We then provide the opportunity to try these different foods at meal times, involving children in the entire process of preparing, cooking, serving, and eating foods.

Children can develop advanced motor skills as well as courage and resilience on our unique and fun bike track. Educators help students learn to ride a bike while creating learning opportunities for resilience, persistence, confidence, and openness to trying new things.

Our research-led, specialist Kindergarten curriculum is an opportunity for three and four-year-old children to begin preparing for the transition into primary school. We begin developing their basic reading, writing and numeracy skills in a patient and play-based environment, helping provide a little bit of a boost for the children when they start school.

We develop each child’s literacy and numeracy skills to help them feel confident and prepared during the challenging leap into primary school. Our program supports the needs and routines of each of our families, and we ensure each child’s cultural background is supported and encouraged.

As part of our unique Visible Learning Program, families will be able to gain an understanding of their child’s education. Our Learning Exchange Display will provide the opportunity for our Teachers and Educators to share updates on your child’s progress. It will also be a chance for you to have direct input into your child’s learning!

Families will have access to our communication app Storypark, allowing us to share important Centre updates, as well as exciting activities or milestones – ensuring that you remain connected, day-to-day.

Guardian Childcare & Education Fig Tree Pocket boasts a passionate and experienced team of Educators and Teachers who have a passion for early learning. We work to understand each child’s development and to support them in their learning and growth. If our new childcare centre is near you, consider taking a look at how we can provide a great start to life for your child.

Guardian Fig Tree Pocket offers longer care hours, from 6.30 am to 6.30 pm on weekdays. Families experience the benefit of flexibility throughout the day, and can drop-off and pick-up their children at a time that best suits them. We welcome you to come on into the Centre at these times and engage in conversation with your child’s Teachers and Educators.

Centre Highlights expand_more

- We have a veggie garden and chicken coop, where children can collect fresh fruits and vegetables, as well as eggs, throughout the day. We then provide the opportunity to try these different foods at meal times, involving children in the entire process of preparing, cooking, serving, and eating foods.

- Plenty of natural space for children to keep their imaginations engaged. We have large open grass areas with beautiful big shady trees for cooling down under in summer. There are also some gorgeous garden areas and a digging patch for when children feel like getting their hands dirty in nature.

- The modern fort is a popular attraction, with the children coming up with all sorts of imaginative games and ideas for how it can be used for learning. We also have two large sandpits, which provide motor skill development opportunities for younger children and introduce an understanding of shapes and building for the older ones.

- A large natural playground that lets children develop their independence and confidence in a safe and secure setting. The outdoor area as a whole is spacious, nestled on three-quarters of an acre, allowing children to roam freely and providing plenty of space for exploration and running around.

Begin the Adventure at Guardian

To explore the centre, chat with our team of Educators and learn more about our high-quality curriculum, book a tour now.